Bond issue

Invest in Inbank's growth

Inbank subordinated bonds offering

23.09.2025-3.10.2025.

€5m

Volume. Can be increased to 10 million euros

if oversubscribed.

6.25%

Annual interest rate. Regular return

paid out quarterly.

10 years

Maturity. Premature redemption possible

after 5 years upon EFSA permission.

Investor webinar

Join Inbank CEO Priit Põldoja and CFO Marko Varik as they present Inbank’s strategy, financial results, and the ongoing bond issue. The session also includes insights from Erkki Raasuke, Chairman of the Supervisory Board, who shares his investment strategy and his experience with bonds.

Investor presentation

Inbank’s investor presentation provides an overview of the bank’s strategy, business, and financial results.

Download hereKey financials

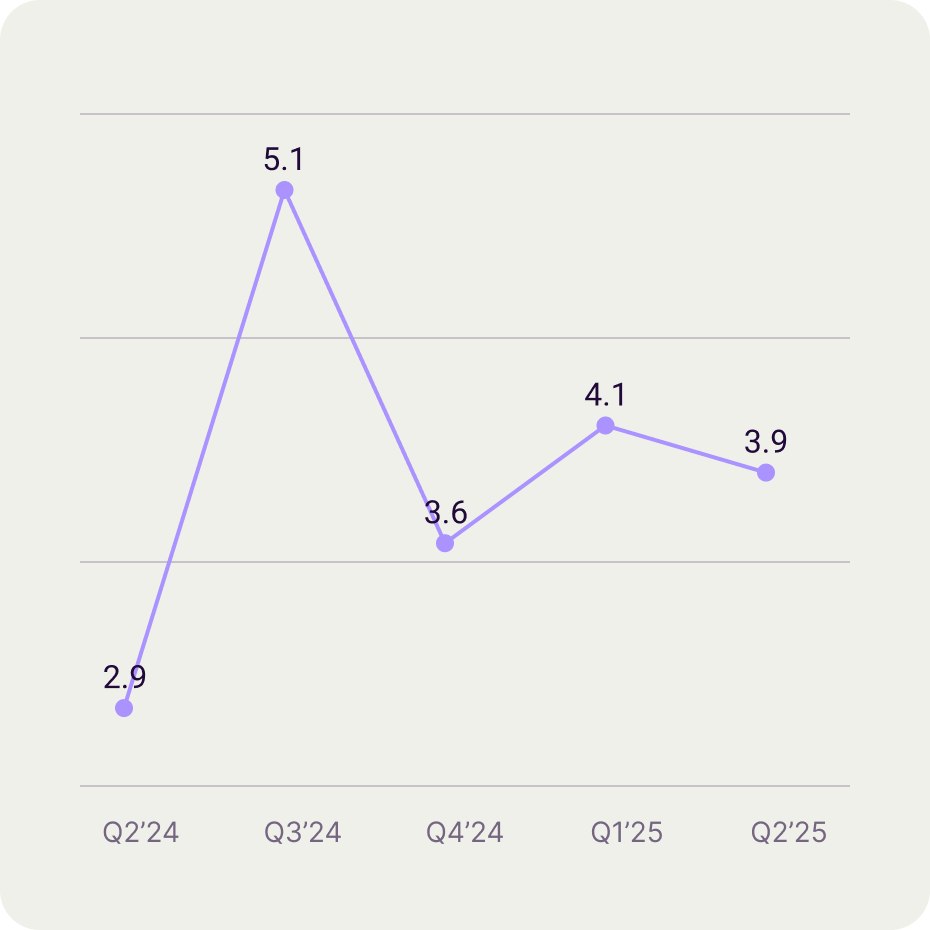

In millions of euros

€195.6m

Originated volume

€21.1m

Total income

€3.9m

Net profit

Inbank subordinated bond issue

The purpose of raising capital is to strengthen our capital base and thereby contribute to Inbank’s international growth.

Volume

The total volume of the issue is €5 million. In case of oversubscription, the volume may be increased up to €10 million.

Term

The bonds have a 10-year maturity. Inbank reserves the right to redeem them prematurely after 5 years, subject to approval by the Financial Supervision Authority.

Nominal value

Each bond is offered at a nominal value of €1,000.

Annual interest

The bonds carry a fixed 6.25% annual interest rate, paid quarterly offering investors a regular and predictable return.

Oversubscription preference

In the event of oversubscription, priority may be given to clients, existing shareholders, bond investors, and institutional investors.

Listing and trading

Application has been made to list Inbank’s subordinated bonds are listed on the Nasdaq Tallinn Stock Exchange under the Baltic Bond List. If listed, the bonds will be freely tradable, enabling investors to buy and sell them on the regulated market.

Timeline

The subscription of Inbank's bonds will start at 10 am on 23 September and end at 4 pm on 3 October. The bonds will be issued on 9 October 2025 or a date near to that and are expected to be listed on the Nasdaq Tallinn Stock Exchange on or near 10 October 2025.

Prospectus

Please review the base prospectus and the final terms of the first series of bonds together with a summary for details.

See prospectusSubscribe to our investor

newsletter and stay up to date

Questions and answers

About Inbank

Inbank is on a mission to bring financing right to the point of sale – where everyday shopping happens. With more than 5,700 retailers in our network, we make financing easier, smarter, and more accessible for over 650,000 unique customers on our platform.

931 000+

Contracts with happy shoppers

5 700+

Retailers with fully integrated seamless financing

8

Markets across Europe and quickly expanding

Our success factors

We’re born in Estonia, one of the world’s most digital economies and we're geared up to disrupt the European market.

Focused

Backed by a diverse network of retail partners, our mission since 2010 has been to support our partners in growing their businesses while ensuring consumers have easy access to financing.

Entrepreneurial

With a sky’s-the-limit mindset and a proven track record of successful joint ventures, we embrace new ideas, leverage emerging trends, and consistently explore new markets for growth.

Tech-driven

Our fully embedded, flexible platform is built on scalable proprietary technology and next-generation underwriting – a formula that consistently delivers success.

Viable

Holding a banking license since 2015, we have access to EU deposit markets and bonds listed on the Nasdaq Baltic Stock Exchange. With 13 years of profitable growth, we are positioned for long-term success.

Make the smart investment

If you have any questions about the bond issue, please reach out to us by emailing investor@inbank.eu.

Contact us